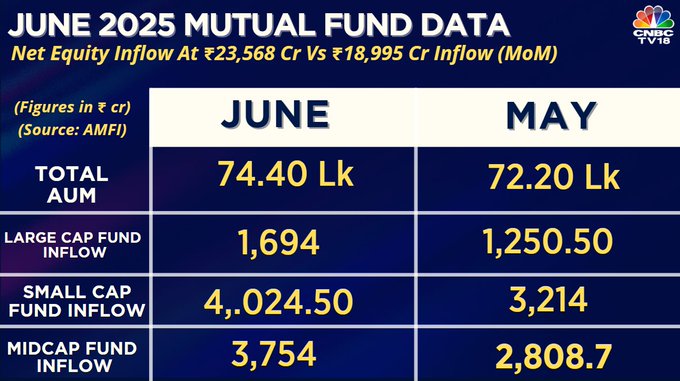

Mid-cap funds followed with ₹3,754 crore in inflows, up 33.6% from ₹2,808.7 crore in the previous month. Large-cap funds registered a 35.5% rise, with ₹1,695 crore coming in versus ₹1,250.50 crore in May.

Among other key segments:

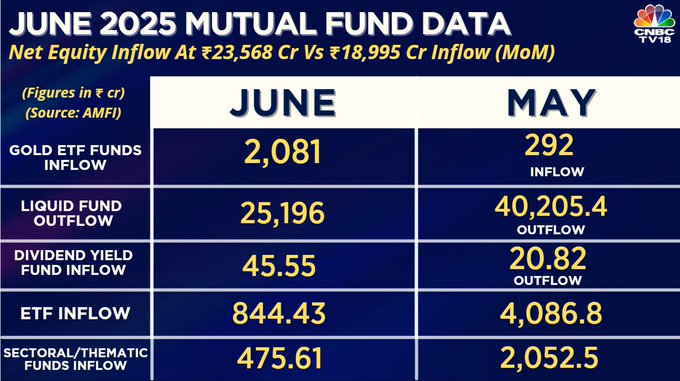

- Gold ETFs recorded a sharp spike in inflows at ₹2,080.9 crore, compared to ₹292 crore in May.

- Dividend yield funds reversed the trend with ₹45.55 crore inflows in June versus ₹20.82 crore outflows last month.

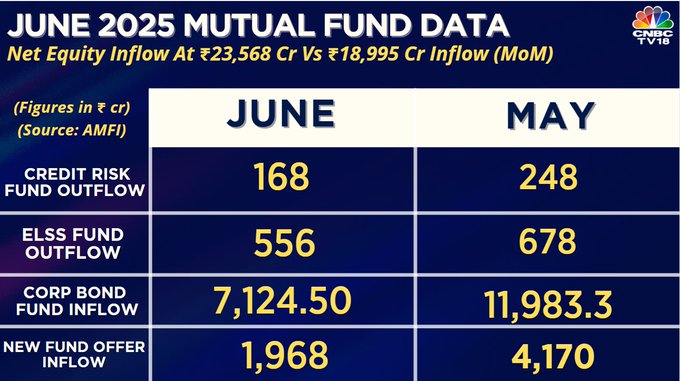

- Credit risk funds saw net outflows of ₹168 crore, narrowing from ₹248 crore in May.

- ELSS funds continued to face redemptions, with ₹556 crore in outflows, lower than ₹678 crore a month ago.

- Corporate bond funds collected ₹7,124.50 crore, down 40.5% from ₹11,983.3 crore in May.

On the other hand, liquid funds saw net outflows of ₹25,196 crore in June, improving from ₹40,205.4 crore in May.

Thematic and sectoral funds saw a drop in demand, with inflows falling to ₹475.61 crore in June from ₹2,052.5 crore in May. Overall ETF inflows also declined sharply to ₹844.43 crore, compared to ₹4,086.8 crore a month earlier.

New fund offers (NFOs) mobilised ₹1,986 crore in June, less than half of May’s ₹4,170 crore.

Commenting on the data, Sandeep Bagla, CEO of TRUST Mutual Fund, said, “The flows are quite robust and, of course, influenced by several factors. The immediate past performance of the equity market is a bit of an influencer. Liquidity conditions also have some minor role to play in the short term. The number of NFOs hitting the market tends to galvanise the distributor community and mobilise large amounts of money.”

Bagla said the month ahead looks positive.

“At least 15 NFOs are approaching the market, including our own Trust MF Multicap Fund. The SIP number has increased, the SIP flows are very robust, and the NFOs will help mobilise more funds into the equity markets this month,” he said.

Catch LIVE updates on AMFI June data here

(Edited by : Amrita)

First Published: Jul 9, 2025 10:59 AM IS