The gold loan business remains the key driver of growth.

Muthoot Finance informed the exchanges on March 14 that its gold loan AUM has crossed ₹1 lakh crore.At the end of the December quarter, gold loan AUM stood at ₹92,964 crore, reflecting a 34.3% year-on-year increase and a 7.9% rise sequentially.

The company’s overall AUM, which includes non-gold segments, reached ₹97,487 crore, marking a 37% year-on-year growth.

George Alexander Muthoot expressed confidence in the company’s growth momentum.“We were conservative in guiding 25-30% AUM growth, but we will end the year at 40%,” he told CNBC-TV18.

He attributed the strong demand to both rural and urban markets, with more borrowers opting for gold loans amid challenges in securing microfinance and personal loans.

For FY26, Muthoot Finance has set a conservative guidance of 15% AUM growth but expects to exceed this target. Net interest margins (NIMs) are projected at 10-11% for FY25 and 10-12% for FY26.

The company is moderating its microfinance portfolio due to short-term pressures but sees ample room for competition in the gold loan segment.

“We are well priced to grow the business,” Muthoot added.

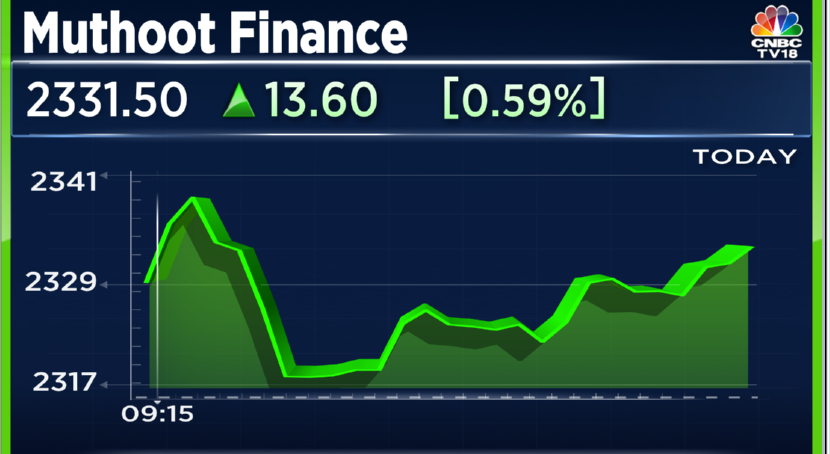

At the time of writing this story, shares of Muthoot Finance were trading over 3% higher at ₹2,396 apiece on the BSE, marking the day’s high.

First Published: Mar 19, 2025 10:32 am IS